Value Creation vs. Value Capture in Orthopedics

Orthopedic Business Review

written by Will Kurtz, M.D.

August 19, 2022

This OBR article will discuss commoditization, market forces, value capture, and value creation. Using these terms, we are going to evaluate orthopedic decisions and discuss how these decisions might affect the future of orthopedics and digital therapeutic (DTx) MSK companies.

Commoditization

We have to acknowledge a painful fact about orthopedics today. Orthopedic surgeons have been commoditized.

Picture created with AI from Dalle

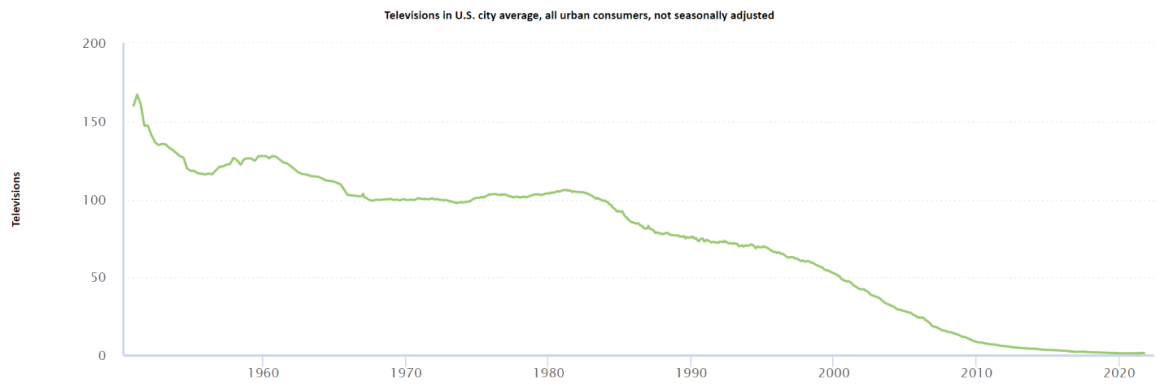

Orthopedic surgeons are like flat screen TV; we continue to create more value every year, only to get paid less for it. The 30 year deflationary rate is 98% for TVs and 66% for total knee replacements. Both have drastically improved quality over this time period.

The commoditization of orthopedic surgery is not our fault. There is no reason to take it personally. Market forces have commoditized both consumer hardware (TV companies, fitness tracker, laptops, flash drives, etc.) and orthopedic providers without our consent.

Commoditization of consumer products

Market Forces

What are the market forces that caused orthopedic surgeons to be commoditized?

Orthopedic surgeons lack pricing power. (i.e. there is no free market)

Surgeon are typically not able to charge higher commercial rates when they provide better outcomes or customer service. Excellent surgeons are rewarded with more volume, but not higher commercial rates.

Insurance companies view providers as interchangeable.

Quality metrics are hard to define, and therefore all surgeons are seen as interchangeable in the eyes of an insurance company and CMS.

The only leverage with insurance carriers is an orthopedic group’s size.

Companies like Healthcare Blue Book and Embold Health are defining quality in order to create narrow provider networks for employers, but most employers are still stuck in the third party administered (TPA) world with no employee steerage.

Ubiquity of information

Today, information and technology proliferates much faster through the orthopedic community than previously. It seems there are as many surgical robots in a city as there are Starbucks.

MSK care delivery knowledge is readily shared and exists at the institutional level: standardized care pathways and robotic surgery are two examples of knowledge sharing that have leveled the playing field between providers.

The Paradox of Skill - Orthopedic quality is so high that subtle differences in outcomes depend more on luck than skill.

Unfortunately, the net result of these market forces is that orthopedic surgeons have invested more in increasing throughput (PAs, urgent care clinics, ASCs) and have invested less in improving the customer experience (virtual PT, patient engagement, content delivery) because the former increases revenue and the later increases overhead. Quality (value creation) is not financially rewarded in healthcare (value capture) because providers have no pricing power. There is no free market with commercial insurance.

Value Creation

Value creation is the increase in value from transforming raw inputs (patients with MSK pain who can’t work) into final products (happy MSK patients who return to work). Value creation is measured by the benefit received by patients.

Value Capture

Value capture measures the businesses’ ability to capture some or all of the value they create. MSK surgeries create significant value for patients, but the value captured is split between hospitals, insurance companies, device companies, post acute care, and orthopedic providers.

Zero Sum Gain

One entity’s value creation in healthcare is often another entity’s loss of their value capture: a zero sum gain. Orthopedist have been successful at stealing other people’s lunch:

Orthopedists create value through BPCI by decreasing utilization of skilled nursing facilities.

Orthopedist create value through commercial bundles by changing the site of care from hospital to ASCs.

Orthopedists create value by moving ancillary services (PT, MRI, Urgent Care) in house and out of hospitals.

Orthopedist have been less unaware of other entities stealing our lunch:

PCPs with ACO or MA plans create value by providing non-op MSK treatments that would otherwise be captured by an orthopedist.

Digital therapeutics (DTx) companies create value with health coaches and virtual therapy by keeping patients out of orthopedic clinics.

Pain clinics providing HA injections to patients with severe arthritis is an example of capture value without creating value. This is not sustainable.

Capturing value through Mergers

Providers often increase value capture through mergers. Small provider groups merge with larger provider groups to improve their commercial insurance rates with no change in value creation. These mergers also occur with hospitals and private equity. A larger scale does not create value despite the press releases claiming that a healthcare merger will improve patient care. It never does.

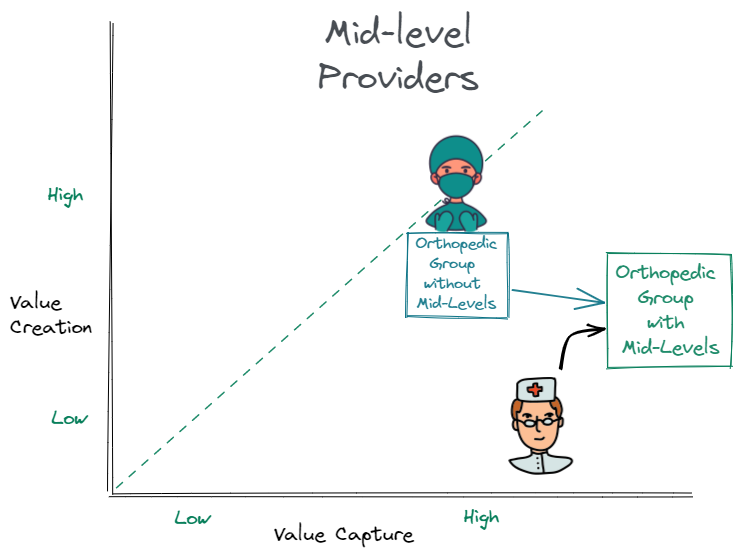

Mid-Level Providers

Orthopedic providers often hire mid-level associates (PAs, NPs) to practice healthcare at the top of their license and increase throughput through urgent care clinics. Mid levels increases value capture for the orthopedic providers. Value creation is slightly increased by improved access and slightly decreased by care delivery with a non-MD providers.

Unnecessary test and procedures

Performing unnecessary surgeries or test increases value capture and decreases value creation which can be financially beneficial for a single provider in the short run, but is damaging to the provider group over the long run. By contrast, valued based care increases value creation and decreases value capture which can be financially harmful in the short run, but builds brand and relevancy for the group over the long run. For orthopedic groups that are only trying to maximize revenue, moving from fee for service with unnecessary procedures to value based care is challenging. Surgeons feel like status quo will never change, and therefore there is no reason to pursue any change that may decrease revenue. Unfortunately, these DTx companies offer value based care that is catching on with employers. Status quo has already changed. We just don’t want to accept it.

Value Creation has a poor ROI

Orthopedic endeavors that increase value creation and improve the customer experience usually increase overhead without an immediate return on investment. Virtual physical therapy provides patient convenience, but decreases in-office PT reimbursement for providers. Because improving the customer experience is not financially rewarded, orthopedic groups do the bare minimum to match their local orthopedic competitor’s customer experience. This is why so many patient engagement applications have failed in healthcare: value creation (improving the customer experience) is not rewarded in healthcare.

Regulatory Capture

Value capture in healthcare is often protected through regulatory capture. To operate a hospital or imagining center, be a physician, open an ASC, provide health insurance, or provide medical advice, you must have an appropriate state license. These licensing requirements keep out competitors. Regulatory capture both helps and hurts orthopedic providers.

Digital Therapeutics Companies

Any disruptive company looks for two things in the market they hope to disrupt: 1) incumbent companies that capture more value than they create and 2) fragmentation among incumbents. Stated another way, a disruptive company looks for incumbents that are on the bottom, right of this graph, which happens when providers order unnecessary tests and procedures. Any new business that is positioned closer to the dashed line (above and to the left of the incumbent) has a chance at disrupting the incumbent.

DTx companies with health coaches, virtual PT, and no imagining or surgery will provide cheaper MSK care than orthopedic providers. DTx companies are left of orthopedic providers on this graph. Hinge Health reportedly charges ~$900 per patient episode and reportedly saves employers ~$5000 per patient. They go at risk; if they don’t deliver savings, they don’t get paid. Hinge Health is not likely providing better patient care (i.e. IMHO, Hinge’s value creation is lower than a provider’s), but they are disruptive because they are lowering their value capture (MSK spend) more than they are lowering their value creation.

Who is sitting at the MSK dinner table?

Orthopedic providers have been trying to steal the hospitals’ lunch for awhile, but we have stopped looking to see who else is sitting at our MSK table. These DTx companies are not beating us at our game; they are playing a different game, a value-based care game. We are using chop sticks, they are using large utensils, and then we are complaining that they take bigger bites than us.

Employers are not requesting Hinge’s virtual PT; they are begging for anyone to deliver value-based care. Employers are saying, “I have to control my cost and get something of value for this enormous expenditure on my balance sheet.” For employers, this is not a Hinge vs. orthopedic provider contest; this is a Hinge for the non-operative top of the funnel and the orthopedic provider for all patients who fail to recovery with Hinge’s DTx. These DTx companies are also using TPAs and insurance brokers as certified resellers to get their DTx services out to employers, and it is working.

Three current paradigm shifts

The three paradigms (direct to employer, value based care, and virtual care) are all interrelated and relevant to these DTx companies. The direct to employer contracting means DTx companies do not have to comply with traditional insurance company rules. Patients do not pay co-pays. The HR directors wants an invisible hand to steer their employees to value based care. They do not want their employees to complain about being forced into a narrow network. Offering free DTx services to employees provides this invisible hand of steerage, and patients are voting with their wallet. DTx companies have an easier time at providing value based care because they are not beholden to the downstream revenue in imagining and surgeries (counter positioning).

When do you need a license to practice medicine?

Full disclosure: this is my regulatory capture complaint.

When does offering “healthy life” advice become offering “medical” advice? “Healthy life” advice can be offered by anyone or any corporation across state lines with little to no liability; medical advice can not. DTx companies hire health coaches to motivate patients to eat healthy and exercise which seems reasonable. However, these health coaches are asking patients about their medical conditions and then providing the patients with disease-specific articles about the benefits of non-operative care. Non-operative care delivered by health coaches may be better for some patients in some situations, but does providing medical articles to patients constitute medical advice? If a MRI imagining company provided medical articles to patients discussing the benefits of MRI, would that be medical advice? Who is deciding which patients get these articles? Who is selecting the articles? Who is to blame when a patient is harmed by a missed or delayed diagnosis? These articles support these DTx companies’ interest since their business model is decreasing utilization to brick-and-mortar MSK providers which is a potential conflict of interest.

By providing free, virtual services with different health coaches, I assume these DTx companies would claim they are not establishing a provider/patient relationship. Like many analog to digital transformations in our society, our existing laws do not appropriately handle virtual healthcare delivery by a health coach without insurance. Our governing bodies needs to clarify these licensing issues that arise when medical care is no longer tethered to insurance and brick and mortar establishments.

Life is a highway

Orthopedic surgeons have been waiting for a “straight away” to pass hospitals on this healthcare highway. We have been overly concerned about what is in front of us, and have forgotten to look in the rear view mirror to see what might be about to pass us on this same “straight away.”

Picture created with AI from Dalle

Conclusion

In a direct to employer market, orthopedic providers can finally be paid for creating value. We have a free market, but we also have formidable competitors (DTx companies) providing value based non-op care. We must invest in digital triage that delivers patients to value-based care providers, improved the patient experience, and deliver value-based care to stay relevant even though the immediate ROI may be lacking. Only be offering more value to patients are we going to be able to keep our orthopedic machines (MRIs, PTs, ASC, etc.) running because the status quo is changing, and there is no putting the genie back in the bottle.

Acknowledgements

The concept of value creation vs. value capture is not mine. On the Acquired podcast, Ben Gilbert and David Rosenthal grade the company being discussed on whether the company is good for society (value creation) and able to be financially rewarded for the value they create. Peter Thiel’s book, Zero to One, also discusses these concepts.