Transitioning from Scarcity to Abundance in Orthopedics

Orthopedic Business Review

written by Will Kurtz, M.D.

December 21, 2021

Scarcity and Supply Sided Monopolies

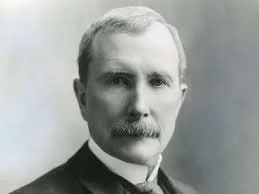

In 1890, people lived in a world of scarcity. If you wanted to see at night, there was a 90% chance that your kerosene in your lamp came from Standard Oil. John D. Rockefeller became the richest man ever by controlling the oil refineries and railroads that supplied kerosene, squeezing value from the demand side (i.e. higher oil prices for customers), and creating a supply sided monopoly. The Sherman Antitrust Act ruled that Standard Oil restrained trade and harmed customers, so the government broke up Standard Oil in 1911.

Few supply sided monopolies exist today because information and resources are readily available. OPEC had a supply sided monopoly, but new oil extraction techniques and electric vehicles have weakened their monopoly. In orthopedics, CeramTec has a rare, supply-sided monopoly on ceramic head balls. Their high fixed cost, brand and cornered resources are a significant barrier to new entries into this market.

Abundance and Demand Sided Monopolies

Today, we live mostly in a world of abundance with efficient markets. When a business over prices their products, another business will come in and undercut them on price. Jeff Bezos famously said, “your margin is my opportunity.”

In contrast to the supply sided monopolies of years ago, today’s monopolies exist by aggregating the demand side (delight customers with low cost/no cost products). If you preform an internet search, there is a 86% chance that search is on Google. Google aggregates the demand side and squeezes the supply side (make advertisers pay dearly for Google ads). Aggregating the demand side has historically been hard because customers are highly fragmented and difficult to organize; however, the low marginal cost of distributing technology and network effects have made it possible to delight billions of people with software. A key tenet to demand sided monopolies is to pass most of the value back to the customer to further strengthen your monopoly. Demand sided monopolies (i.e. Amazon) often take a long term strategy, lower their margins to increase their customer volume, and thereby increase their leverage over suppliers. Because customers often receive cheaper prices, government regulators have not typically intervened when demand-sided monopolies squeeze suppliers.

Supply Sided Monopolies in Healthcare

The consolidation of healthcare services through mergers and acquisitions of hospital systems and clinically integrated networks (CINs) is an attempt to create supply sided monopolies. Government regulators have raised concerns about how healthcare prices go up when hospital systems merger. Supply sided monopolies can make it harder for new entrants to get started in healthcare, but when these new entrants find traction, they can quickly disruption the old incumbents who have used their supply sided monopoly to extract value from patients through higher prices. ASC joint replacements are an example of disrupting a hospital’s control of the supply of operating rooms and hopefully giving some of that value back to patients and employers.

Demand Sided Monopolies in Healthcare

Group purchasing organizations (i.e. HealthTrust) aggregate customers (hospitals) and negotiate lower cost of goods from suppliers. Large hospital chains through their GPOs aggregate the demand for orthopedic implants and drive down the ASP (average selling price) on orthopedic implants (i.e. purchasing power). Single and dual vender implant contracts are an example of hospitals aggregating their orthopedic implant demand to try to lower their implant cost.

Narrow networks allow patients to aggregate their demand for healthcare in return for fewer choices and lower prices. The most obvious example of a narrow network creating a demand sided monopoly is Medicare. The government exerts pricing pressure on providers and hospitals because most providers and hospitals can’t opt out of 40% of their serviceable market. Medicare’s demand monopoly is weaker than Google’s because Google pulls customers into their services by giving them the best search options, and Medicare pushes patients into Medicare through government edict.

Transitioning from Scarcity to Abundance

Healthcare services (along with the rest of our economy) are transitioning from a world of scarcity to a world of abundance. The supply of healthcare services has historically been restricted through regulatory capture. Certificate of Need (CONs) were often required to provide healthcare services (operating rooms, ASCs, MRIs, ERs, etc.). Thirty years ago, almost all surgeries were done in hospitals. Now, over half (52%) of all surgeries are now done in an ASC. Thirty years ago, most major cities had 2-3 emergency rooms. Today, most major cities have 30-40 urgent care clinics in many grocery stores. These new entrants create abundance, fragment the supply side, and give patients choice. Telehealth has the potential to further fragment the supply side similar to how e-commerce has gained market share from brick and mortar retailers.

Regulatory Capture

Regulatory capture strives to keep healthcare resource scarce. Regulatory capture can make it difficult for new entrants to entry a market, but government leaders are beginning to acknowledge that regulatory capture limits competition and increases prices. The affordable care act’s ban on physician owned hospitals is an obvious exception to this trend of loosening regulatory capture. Businesses protected by regulatory capture often take their customers for granted through higher prices and are now being targeted for disruption. Orthopedic surgeons often recognize how loosening up these restrictions on the supply side could help them disrupt hospitals and payers (i.e. physician owned ASC), but fail to recognize the dangers of being disrupted by digital health, telemedicine, and lower cost providers like physical therapist and physician assistants. The telehealth parity laws, removing the laws regarding practicing across state lines, and allowing PAs/NPs to practice independently are examples of how loosening regulatory capture could increase competition from new entrants in the MSK space. In short, orthopedic surgeons exist on both the supply side and the demand side. When we need operating rooms, we are the demand side; when we treat patients, we are the supply side. This duality gives us options to disrupt and to be disrupted.

Quality with Convenience over Quality alone

As I discussed in my previous blog, The Paradox of Skill, the difference in outcomes between surgeons is smaller today than previous decades. Three decades ago, most major cities had a few good joint replacement surgeons. Now, there are probably 3-5 times more great joint replacement surgeons in every major city. Patients can not perceive the difference between most orthopedic surgeons. Most surgeons have 100’s of positive Google reviews. When patients have analysis paralysis from the abundance of positive reviews, they often select providers who offer convenience. In a world of abundance, every surgeon is well trained, and every facility offers the latest technologies (robotics, etc.). In this world of abundance, surgeons can’t just claim that they are best surgeon in their area; they also have to be relevant to patients with convenient access.

Scarcity vs. Growth Mindset

Accepting that we no longer live in a world of scarcity and now live in a world of abundance could affect your mindset. Instead of thinking, “I am the best surgeon in my city and any patients would be lucky to have me as their surgeon”, we all should realize there are many great surgeons in our area, and we (i.e. surgeons) would be lucky to have patients select us to be their surgeon. We must earn a stellar reputation by delivering an amazing customer experience (i.e. Ritz Carlton), so that our patients will tell their friends about us. Orthopedic surgeons must aggregate the demand side by offering our patients more value to stay relevant in our contract negotiations with payers, employers, and other healthcare entities. We must create a feedback loop: delight patients with extra patient services, which increases patient demand for our services, which increases our negotiating leverage over payers, which increase our profitability, which increases our ability to offer more patient services. Examples of extra patient services could be a personal health coach, more convenient access, prompt pay patient discounts, online appointment scheduling discounts, and/or patient rebates through third party vendors like Healthcare BlueBook. Many payer contracts limit a provider’s ability to directly rebate our patients, and the rebate should reflect the cost savings achieved by the patient’s actions.

A scarcity mindset is a zero sum gain; when another orthopedic surgeon does my favorite surgery, I lose because I should have done that patient’s surgery. A growth mindset acknowledges that my competitor and I can both be successful because the market is growing rapidly. The Arthritis Foundation study in 2014 estimated that about 7 million patients need a TKA. About 700,000 patients get a TKA each year, so only 1 in 10 patients are getting the knee replacement they could potentially need. A scarcity mindset would consider bad mouthing the competition across town to steal a piece of their pie. A growth mindset would consider how to educate patients on the benefits of knee replacements to grow the whole pie.

Conclusion

Regulatory capture and large health systems have attempted to create scarcity in healthcare over the past 4 decades. These supply sided monopolies have extracted high prices from patients and employers. The relaxing of regulatory capture and new entrants into healthcare will creat abundance in healthcare which will weaken the incumbents’ power over the supply side. The battle for successful healthcare businesses today and in the future will be fought on the demand side by delighting patients. For orthopedic surgeons to stay relevant, they must delight their patients with better access and customer experiences to win the demand side and thereby prevent getting disrupted by new entrants and possibly disrupt some old incumbents.