Will MSK Providers prevail over MSK Digital Health?

Orthopedic Business Review

written by Will Kurtz, M.D.

August 30, 2021

Introduction

Our previous article, How digital health could disrupt orthopedic provider, discussed how musculoskeletal digital health (MSK) companies like Hinge Health, Sword Health, Kaia Health, Physera, (recently acquired by Omada Health) Kiio, and Fern Health might change the delivery of MSK care with their digital care programs (DCPs). This article discusses the counter-point: how MSK providers might prevail in MSK care.

The value of any business is their competitive advantage multiplied by their total addressable market (TAM). This article will analyze the competitive advantages and TAMs for both MSK providers and MSK digital health companies.

Competitive Advantages of MSK Digital Health Companies

As a recap from our previous article, the competitive advantages of MSK digital health companies are their cost structure, scalability, multi-homing, value based care approach, direct to employer contracting, and funding. MSK digital health companies have no physical presents (no facility cost) and can provide care with physician extenders which gives them a favorable cost structure. Their scale theoretically allows them to serve the 86% of Americans with internet access and sell into large nation-wide employers. The ease of implementation of digital care programs (DCP) allows patients to multi-home. Customers can use Uber or Lyft; patients can participate in a DCP from a MSK digital health company and still seek out care from a MSK provider. The DCP can be an adjunct to tradition in-person MSK care. MSK digital health companies are not beholden to the revenue from inappropriate, unnecessary, or expensive healthcare, so they can tailor their business to inexpensive, value based care without disrupting their existing revenue stream (counter-positioning). MSK digital health companies contract directly with employers, so they avoid the headaches of prior authorizations, revenue cycle management, and contracting with 1000’s of health insurance companies. Digital health companies are not restricted by state lines. Many MSK digital health companies have large amounts of VC funding, technology prowess, and willingness to innovate which could provide an advantage in customer acquisition and faster adoption of patient-centric digital tools.

Competitive Advantages of MSK Providers

The competitive advantages of MSK providers are their bundling, branding, diagnostic advantages, therapeutic advantages, cornered resource, and regulatory capture.

Bundling

MSK providers offer a complete array of non-operative and operative MSK care. Most patients expect to receive some in person treatment (injections, casting, surgery, etc.), so they do not start their journey with a MSK digital health company.

Many orthopedic groups like OrthoCarolina and CORE bundle operative and non-operative MSK care by offering population health (capitation). These groups deliver all MSK care to a large cohort of Medicare Advantage patients for a PMPM (per member, per month) fee. By aligning incentives to provide cost effective care, these large orthopedic groups can invest in digital health technologies that lower the cost of care. Through population health management, orthopedics groups can be rewarded for providing value from eliminating inappropriate testing, unnecessary surgeries, readmissions and changing site of care, thereby eliminate the counter-positioning advantage of MSK digital health companies. They can change the site of care from expensive hospitals to more cost effective ASCs and from ERs to orthopedic urgent cares. These groups can be rewarded for providing good, value-based care. Population health management provides predictably recurring revenue (like SAAS) as a buffer in case healthcare spending decreases from another pandemic or other catastrophe which lowers healthcare consumption and hurts fee-for-service providers. Because population health allows providers to offer value in non-operative and operative MSK care, they can provide their non-operative services at a substantial discount (free, initial virtual care visit) and capture their revenue with their downstream operative services and in office ancillaries. Many MSK digital companies will not be able to compete with full service orthopedic providers because they will not be able to discount their only revenue source, i.e. virtual care visits.

Branding

Healthcare requires more trust and branding than other businesses. Brands in healthcare matter, which favors incumbents. Most patients are nervous about healthcare procedures, so they trust their previous providers more than an unknown entity (high switching cost). When patients need a new provider, they usually ask for referrals from their friends, family, or PCP, which again plays to incumbents’ advantage. By offering full service MSK care, MSK providers will be the prominent local brand in MSK care. The more patients a provider treats, the greater the provider’s brand becomes, and the more patient referrals the provider receives.

Most digital products with great brand awareness require high daily active users (DAUs) to maintain their brand and stay relevant. You get your daily news from Facebook and every car ride from Uber/Lyft. MSK digital health companies will not get high DAUs. Patients may use the app during an injury and then forget about it. MSK digital health companies are tied to the employer and not the employee, so the MSK digital health company will lose that employee every time that employee leaves their employer.

Diagnostic Advantage

MSK providers have a definite diagnostic advantage over a digital health company. Radiographs and physical exam are necessary for most MSK diagnosis especially for acute injuries. Until a remote or in home product can make a more accurate diagnosis than an in-person MSK provider, MSK digital health companies will have to rely on a MSK provider to make that accurate diagnosis.

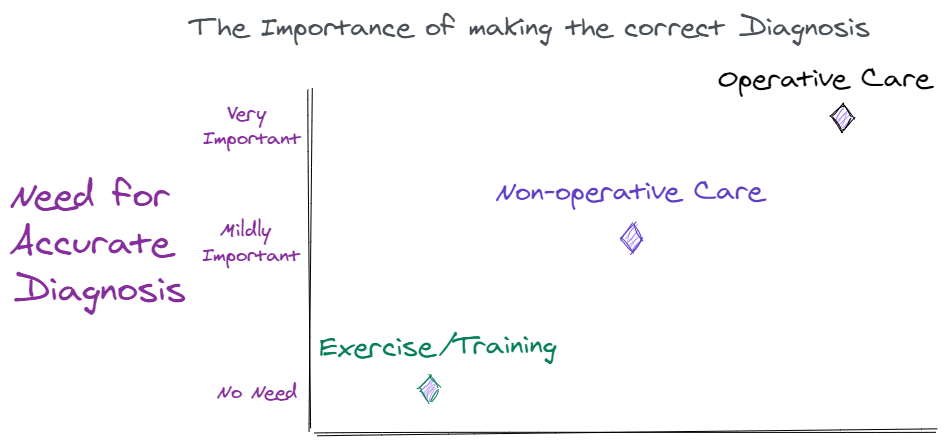

MSK care can be lumped into three buckets: exercise/training, non-operative care, and operative care. The importance of making the correct diagnosis increases as the severity of the patient’s problems increases and the consequences of the treatment increases.

Exercise and training is the MSK equivalent of preventative medicine and has typically been overseen by personal trainers and not MSK physicians. The MSK problems that arise from routine exercise are relatively small. The consequence of recommending exercises is negligible. Making an accurate diagnosis is not typically necessary to engage in routine exercises. Internet-based, home exercise companies like P90X, FitBit, Peleton, etc. have disrupted some brick and mortar exercise facilities like gyms and pools because there is little to no need to make a diagnosis. On the other hand, before a MSK digital health company can opine about the appropriateness of surgery and treatment options, they need an accurate diagnosis that is currently only possible with in person evaluations. Therefore, most telemedicine companies have worked with in-person providers instead of trying to disrupt them.

Therapeutic Advantage

Many MSK treatments (i.e. injections, joint aspirations, casting, and surgical procedures) require the patient and provider to be in the same room. Limiting a patient’s therapeutic options to virtual physical therapy, remote patient education, and mental health check ups will limit MSK digital health companies from providing the most effective therapeutic options.

Cornered Resource

MSK providers have a cornered resource in their EHR. A patient’s previous MSK care may affect their future MSK care, so the knowledge about what previous care has been provided is important. Patients often can not adequately explain their previous MSK care, so the switching cost for changing MSK providers (even to a digital provider) is high because some of the patient’s past health data may not be transferred to the new provider or digital care program (DCP). Health systems often do not exchange patient records with other health systems specifically because they want to discourage patients from leaving their facilities.

Regulatory Capture

Regulatory capture refers to a business using government rules to protect itself from competition in the name of protecting the consumer. In healthcare, regulatory capture refers to state license requirements that make it hard to provide medical services across state lines. During COVID, many payer and state governments removed these restrictions on telehealth across state lines and offered payment parity between telehealth and in person visits. This moratorium on restrictions has past, and MSK digital health companies that wish to offer medical advice will need licensed providers in every state, which adds complexity and cost to their operations.

Total Addressable Market of MSK Digital Health Companies

The total addressable market (TAM) for MSK digital health companies has been over estimated. The worldwide TAM for all MSK is about 70 billion. While MSK digital health companies can theoretically serve every online American, in truth, only a small subset of MSK problems can effectively be treated with a digital care program. First, patients need an accurate diagnosis which means patients have already consulted with a MSK provider. Second, patients need to have a chronic problem where surgery, injections, and in person physical therapy are not good options. The ideal addressable situations for DCPs are depressed and/or obese patients with chronic pain and no clear diagnosis for their pain despite a thorough workup. These patients will often benefit from frequent check ins by a virtual health coach, which can significantly improve the patient’s overall health and mood. Patients with acute injuries and/or in need of surgical procedures may be harmed from the delay cause by inappropriate care from DCPs.

Lastly, the patient needs to be an employee in a large corporation since these MSK digital health companies are contracted with large corporations. When MSK providers offer population health and direct to employer contracting to these large corporations, the MSK providers will be able to capture the value created by digital care programs, appropriateness of care, change in site of care, and other cost savings options. Since these large corporations (i.e. Walmart) want nationwide scale, orthopedic practices will have to merge and/or provide a nationwide network to adequately compete with digital health companies.

In conclusion, the question remains, will digital health companies learn how to deliver great MSK care or will MSK provides learn how to deliver a great digital experience first?

Orthopedic Business Review is a monthly-ish publication dealing with the business aspects of an orthopedic practice. If you wish to contribute to the publication, please contact us using the link below.

Previous articles: